Business Expenses - What You Can't Claim

In this latest blog post we try to create some clarity around expenses you can claim versus expenses you can’t claim in your business accounts. Ask us about Xero training to help you stay ahead of your accounts.

What can you claim in business?

As accountants I think the question, we get asked most is ‘Can I claim...', I don’t mind this question if you are asking us you are asking the right people, advice from ‘Joe’ down at the pub is probably not going to be accurate!

The tax definition to answer this question is;

An expense can be claimed if it directly relates to the earning of revenue

To clarify the above what this means is when you are looking at claiming that expense, if you were not earning an income would you still have that expense? If the answer is yes then it probably isn’t a deductible expense.

When you are running a business 90% of the expenses you pay will be deductible expenses, it is the other 10% which sit in the grey area. And it also depends on your industry, if you are running a farm and you purchase a cow, this is a deductible business, however if you run an e-commerce business and buy a cow, it's very unlikely we can claim this as a deductible expense.

Another consideration for us is if the expense is related to an asset like a vehicle or a piece of machinery, who owns that asset. If the asset is owned by you personally then chances are this is a personal expense and not deductible for the business. This question does not apply if you are a sole trader, as a sole trader you will own all the assets. There are some very specific rules around assets, so please do get in touch if you want to discuss what you can and can’t claim.

Some common examples below...

Home Office

When you do some of your work from home you can claim a portion of your household expenses. The rate we can claim depends on industry and office measurements so talk to us about how much to claim. But if you do complete some work from home, we can look at claiming a portion of Electricity, Insurance, Rent, Mortgage Interest and Internet as examples. Some have a GST claim some do not. If you are farming, the rules on this are different get in touch to dicsuss these specific rules.

Medical Expenses & Personal Grooming

Costs related to visiting the doctor, chiropractor or acupuncturist are not deductible. These are personal expenses and generally we are not able to claim these as a business expenses.

Insurance

Income protection insurance or loss of earnings insurance is claimable, so please send this information in with your end of year accounts so we can claim this deduction for you.

Insurance that relates to business assets or deriving income in the business is a deductible expense.

We can claim a portion of your home insurance if you run an office at home.

Insurance on personal assets, like a boat are not deductible

Motor Vehicle

You can claim all of your vehicle expense if it is used for business all of the time and you have or use another vehicle for personal use. We also look at the type of vehicle, is it sign written, what type of business you are running.

If your vehicle doesn’t meet the criteria we will discuss with you your options for including a personal adjustment.

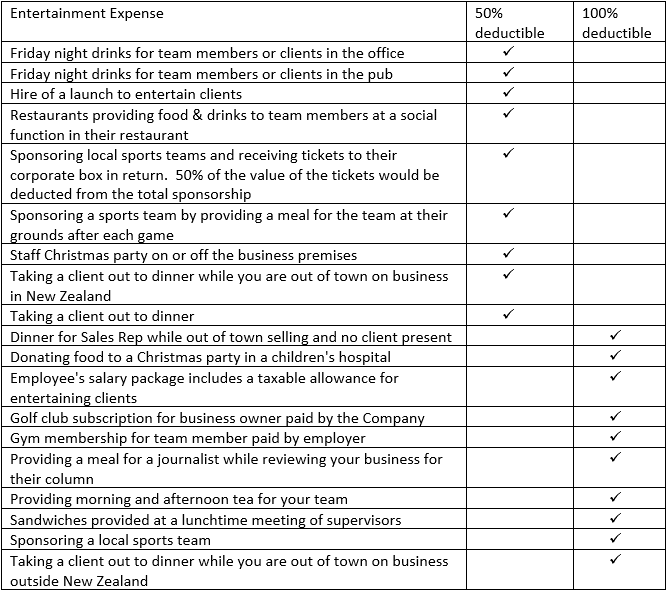

Entertainment

You can claim a portion or sometimes all of what you pay for entertainment. To the left is a helpful table to assist with this question.